Auction trade of FSE-listed securities

Summary of FSE Auction trade

Securities company places order as a broker and FSE executes trades based on the FSE Trading Manual. After trade execution, FSE informs investors via brokerage firm that placed order has been matched in the market. FSE simultaneously posts market matched price and number of units onto market information dissemination system for public announcement.

In August 2000, floor trading of FSE-listed securities ended and trading was transferred to an automated quotation system.

Trading Hours

Holidays: Saturdays, Sundays, National Holidays, December 31st, January 1st, 2nd, 3rd

| Tradable securities | Trading hours |

|---|---|

| Stocks Convertible bonds |

|

| Bonds |  |

Auction

FSE conducts auction trade of foreign stocks in two ways: regular trading and cash trading. For regular trading, which is a basic trading way, brokers settle stocks and cash 3 days from the date of trading(T+2).

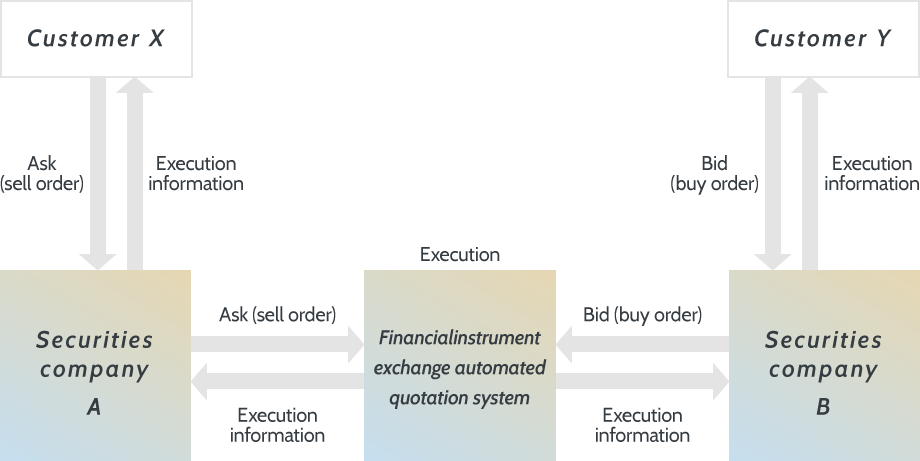

Automated quotation system

FSE specifies rules with regard to the automated quotation system so that FSE can facilitate the execution of fair and smooth trade in large volumes

- Detailed trading procedures are as follows:

- - Customer X places ask order to securities company A

- - Customer Y places bid order to securities company B

- These orders stated above are placed onto the automated quotation system, and outstanding orders are maintained in an order book in time-price priority queues. After trade execution, FSE informs investors via brokerage firms that placed order is matched.

- Pricing process

- For regular trading, FSE conducts two auction methods: "continuous double auction" and "opening (closing) auction" during and at the start (end) of each session.

(1)Continuous double auction

This is a mechanism to continuously determine the price at which trades are executed after the opening price is determined during two trading sessions. Trading rules are based on price-time priority.

- Price priority

- o In the ask queue, the lowest ask has priority over other outstanding asks. Likewise, in the bid queue, the highest bid has priority over other outstanding bids. o Market orders have priority over all limit orders.

- Time priority

- o Among limit orders at the same price, the oldest order has priority over other outstanding orders.

(2)opening (closing) auction

An opening (closing) auction is used to determine opening (closing) prices.In this auction method, FSE considers that all bids and asks in the order book have been registered simultaneously, which means no time priority is applied, and bids and asks are matched at a single price, or execution price, based on price priority. Orders are executed in an orderly way as follows:

- All market orders at the execution price

- All asks (bids) at lower (higher) prices than the execution price

- The entire amount of either all bids or all asks at the execution price:

Trading management

FSE endeavors to manage trade execution fairly and smoothly from the standpoint of public-investor protection by price determination based on the FSE Trading Manual, public announcement of order book information, and trade execution information for individual securities.